Huawei is reportedly developing a new AI chip, the Ascend 910C, designed to compete directly with Nvidia’s high-performance GPUs in the Chinese market. This development is a strategic response to growing tensions and trade restrictions between the U.S. and China.

As Huawei seeks to fill the void left by Nvidia due to U.S. export controls, the Ascend 910C could significantly alter the competitive landscape in the AI chip industry, with broad implications for global technology markets and financial sectors.

Background: The Impact of U.S. Sanctions

The U.S.-China semiconductor conflict has intensified, with the U.S. imposing strict export controls on advanced technologies, including Nvidia’s AI GPUs. These restrictions have created a gap in the Chinese market that Huawei aims to fill with its new Ascend 910C chip.

According to Huawei, the Ascend 910C is on par with Nvidia’s H100, though the specific benchmark terms for this comparison remain unclear. Reports from Wall Street Journal indicate that Huawei has been testing the chip with several major Chinese companies, including ByteDance, Baidu, and China Mobile, positioning Huawei as a potentially credible competitor in the AI hardware market.

Huawei’s Ascend 910C vs. Nvidia’s Market Leadership

The Ascend 910C presents a significant challenge to Nvidia’s leadership in the AI market, particularly within China. Nvidia’s response to U.S. export controls has been the introduction of lower-performance chips tailored for the Chinese market; however, these offerings have not fully met industry expectations.

According to Dylan Patel, an analyst with SemiAnalysis, Huawei’s Ascend 910C represents a significant technological advancement and could potentially outperform Nvidia’s upcoming Blackwell-based B20 processor. Despite this potential, detailed comparative performance data has not been provided. The B20, which is also intended for the Chinese market, remains subject to U.S. regulatory approval, adding another layer of uncertainty to Nvidia’s strategy.

To better understand how the Ascend 910C compares to Nvidia’s H100, here’s a comparison of their key features:

Huawei Ascend 910C vs. NVIDIA H100

| Feature | Huawei Ascend 910C | NVIDIA H100 |

| Architecture | Da Vinci | Hopper |

| Release Date | October 2024 | Q4 2022 |

| Performance (FP32) | ~9.7 PetaFLOPS | ~19.5 PetaFLOPS |

| Power Consumption | 310W (per 8 cards) | 700W |

| Memory | HBM (Details TBD) | 80 GB HBM2e |

| Software Support | CANN (Huawei’s AI framework) | CUDA, TensorRT, cuDNN |

Market demand for the Ascend 910C is anticipated to be strong, with early discussions suggesting potential orders exceeding 70,000 units, valued at approximately USD 2 billion (14.3 billion Yuan). Huawei plans to commence shipments by October 2024, though the company faces potential production challenges and the risk of further U.S. sanctions.

Despite these challenges, Nvidia’s stock has recently experienced a significant rise, closing 6.5% higher at USD 116.14 on Tuesday, following a 4.1% increase on Monday. This upward trend is driven by analyst expectations that Nvidia will exceed its upcoming quarterly earnings projections, with forecasted revenue of USD 29.9 billion. The continued strong demand for AI chips globally, despite potential setbacks in the Chinese market, has reinforced investor confidence.

Nvidia’s ability to maintain its leadership, particularly in regions outside China, will be crucial as it faces growing competition from Huawei. Recent stock performance suggests that investors remain optimistic about Nvidia’s future prospects, especially given the anticipated growth in AI demand, which could sustain the company’s long-term success.

Market and Global Implications

Huawei’s expansion into the AI chip market is indicative of a broader trend among Chinese tech companies aiming for greater self-sufficiency amidst geopolitical tensions. The success of the Ascend 910C could contribute to a more fragmented global AI chip market, as Chinese firms increasingly turn to domestic technologies. This shift could disrupt established supply chains and create both opportunities and risks for global investors.

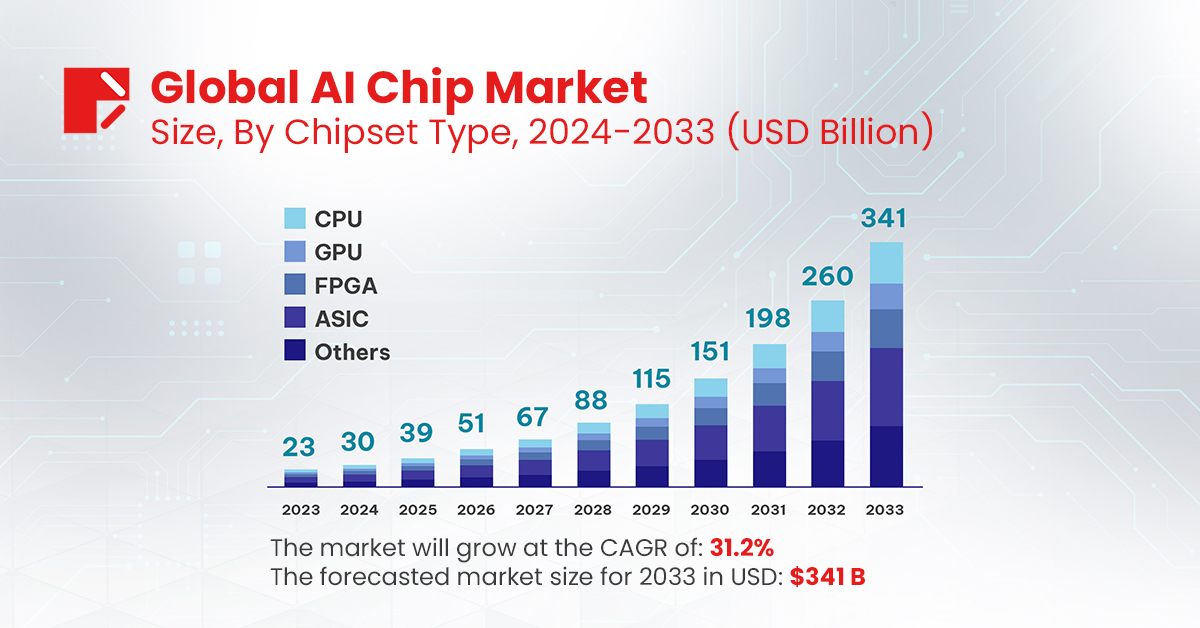

Image Source: MarketUS

The global AI chip market is projected to grow significantly, expanding from USD 23.0 billion in 2023 to approximately USD 341 billion by 2033, with a compound annual growth rate (CAGR) of 31.2% from 2024 to 2033.

This rapid expansion underscores the importance of the competition between Huawei and Nvidia. As the market evolves, the interactions between these two companies will play a critical role in shaping the future of AI technology and the broader semiconductor industry.

For investors, the shifting landscape presents both challenges and opportunities. Nvidia’s potential loss of market share in China could lead to a reassessment of its growth outlook, while Huawei’s rise in the AI chip market could attract new investment into China’s tech sector. The broader implications for the semiconductor industry, particularly regarding supply chain dynamics and global market fragmentation, will be critical factors for investors to look out for.

Ethical and Geopolitical Considerations

As Huawei and other Chinese companies continue to develop advanced AI chips, ethical and geopolitical considerations are becoming increasingly important. The potential for these technologies to be used in surveillance or military applications raises significant concerns, particularly in the context of the ongoing U.S.-China rivalry. Investors should be aware of these risks as they assess the long-term implications of the developments in the AI and semiconductor industries.

Huawei’s Ascend 910C is more than just a new competitor in the AI chip market; it represents a strategic response to the intensifying U.S.-China tech conflict. As Huawei challenges Nvidia’s dominance in China, the global AI hardware landscape is poised for substantial change. For investors and traders, understanding the broader implications of Huawei’s latest moves, along with Nvidia’s continued performance in other markets, will be crucial in navigating the complexities of global markets and the evolving semiconductor industry.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.