Recently, Bitcoin surpassed the $100,000 mark, just 14 years after it first crossed the $1 threshold, making headlines across the globe. This milestone is a monumental moment for Bitcoin, but it’s also a pivotal event for the entire altcoin market, with key altcoins like Dogecoin, Ethereum, Solana, and Shiba Inu rising in its wake.

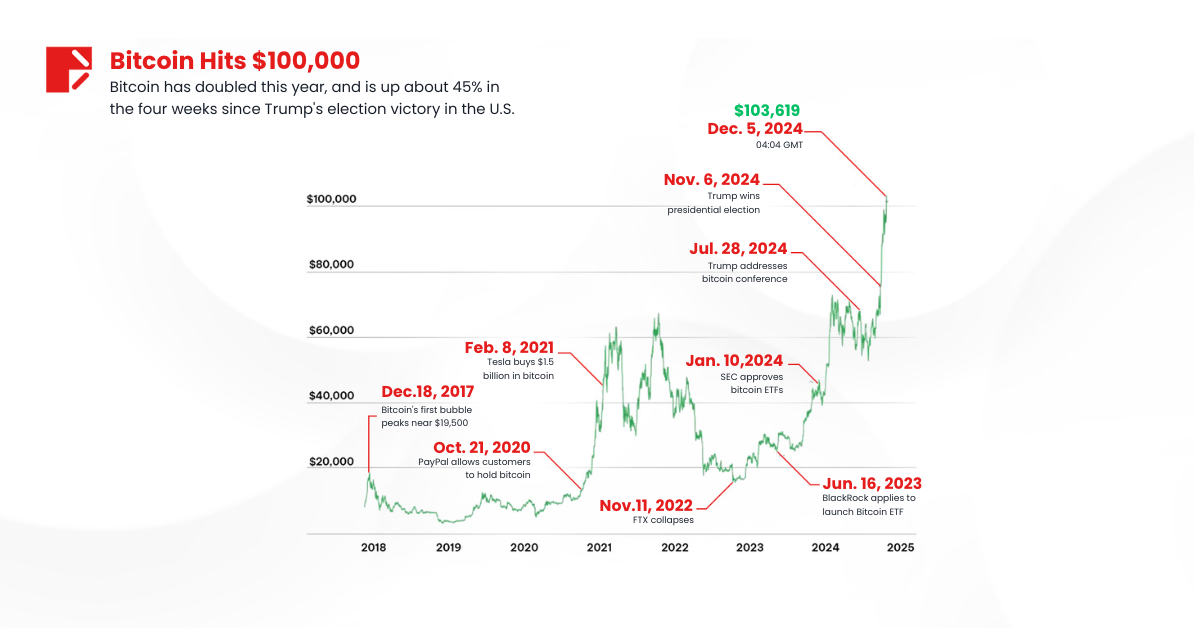

Bitcoin’s rally has been nothing short of spectacular. Over the past 30 days, Bitcoin has surged nearly 50%, climbing from $69,374 to $103,679, driven by a perfect storm of catalysts. Chief among them is the political shift in the U.S., with Donald Trump’s election win and his commitment to making America the “crypto capital of the planet.” Trump’s decision to nominate Paul Atkins as SEC chair has only added fuel to the fire, signaling a shift toward a more crypto-friendly regulatory environment.

As Bitcoin rises, altcoins are experiencing a rally of their own. Dogecoin has surged 9% to $0.46, outpacing both Bitcoin’s 7% gain and Ethereum’s 5% increase. This pattern is common in crypto history — when Bitcoin rises, it drags the entire market upward. This article will explore how Bitcoin’s success is powering the broader altcoin market and why Dogecoin, Solana, and Ethereum are leading the charge.

Why Bitcoin’s Rise Past $100K is a Big Deal

Breaking the $100,000 barrier is more than just a symbolic achievement — it shows that Bitcoin is being taken more seriously as a financial asset. The price action was dramatic, with Bitcoin surging from $99,000 to $103,679 in just two hours on December 6, 2024, before stabilizing at $99,974.

This surge has been fueled by two key factors:

- Donald Trump’s Pro-Crypto Policies

- The Rise of Spot Bitcoin ETFs

Since early November, Bitcoin has jumped nearly 50%. Some analysts believe $150,000 is next. But there are also warnings that Bitcoin’s history of sudden corrections could repeat itself. Analysts have flagged that Bitcoin looks “overbought” on daily, weekly, and monthly charts, meaning a pullback could happen at any time.

Trump’s Pro-Crypto Policies Spark the Rally

The impact of Trump’s presidency on the crypto market cannot be overstated. Upon winning the election, Trump promised to turn the U.S. into the “crypto capital of the planet”, a statement that immediately boosted investor confidence. The announcement of Paul Atkins as the incoming chair of the Securities and Exchange Commission (SEC) further fueled the rally. Atkins, a known advocate for crypto-friendly policies, is seen as the opposite of outgoing SEC chair Gary Gensler, who had a reputation for his harsh crackdown on crypto companies.

With Atkins leading the SEC, the possibility of regulatory relief has brought institutional investors back into the market. ETFs (Exchange-Traded Funds) have played a significant role in this shift. The SEC’s decision earlier this year to approve spot Bitcoin ETFs gave institutional investors a new way to gain exposure to Bitcoin without having to hold it directly. This move opened the floodgates for fresh capital from institutions, and as Bitcoin rose, it set off a chain reaction in the broader market.

Spot Bitcoin ETFs and the Role of Institutions

The approval of spot Bitcoin ETFs in January 2024 was a major turning point for Bitcoin’s growth. Unlike futures ETFs, spot ETFs are backed by actual Bitcoin, giving investors direct exposure to the cryptocurrency. This change made it easier for large institutions and traditional investors to enter the crypto market using familiar financial tools, like ETFs, instead of relying on crypto exchanges.

The result? Institutional inflows skyrocketed, driving Bitcoin’s price higher. From October to December 2024, Bitcoin’s price rose from $97,202 to $99,974, fueled by ETF-related purchases. The approval of spot ETFs is seen as a pivotal moment for Bitcoin’s long-term growth, as it increased investor demand and legitimized Bitcoin as an institutional-grade asset.

As Bitcoin’s dominance reached 56%, the surge also had a ripple effect on altcoins like Dogecoin, Solana, and Shiba Inu, pushing their prices higher. With spot ETFs providing an easy entry point for large investors, many analysts believe this shift could spark an altcoin season as traders seek greater returns from smaller-cap coins.

How Bitcoin’s Surge is Boosting Altcoins

Bitcoin’s surge past $100,000 hasn’t just made headlines — it has ignited a broad rally across the altcoin market. Historically, when Bitcoin makes a major move, altcoins follow, and 2024 is no different.

This trend occurs because of Bitcoin’s role as the market leader. When Bitcoin’s dominance grows, investor sentiment shifts to smaller, more speculative assets in search of higher returns. This rotation often marks the start of an altcoin season.

Here’s how key altcoins performed from December 5, 2024, to December 6, 2024:

| Cryptocurrency | Closing Price on Dec 5, 2024 | Closing Price on Dec 6, 2024 | % Change |

|---|---|---|---|

| Bitcoin (BTC) | $97,202 | $99,974 | +2.85% |

| Dogecoin (DOGE) | $0.43 | $0.44 | +2.33% |

| Ethereum (ETH) | $3,796.87 | $4,013.73 | +5.71% |

| Solana (SOL) | $237.30 | $237.01 | -0.12% |

| Shiba Inu (SHIB) | $0.00003062 | $0.00003085 | +0.75% |

| Pepe (PEPE) | $0.00002138 | $0.00002168 | +1.40% |

Is the Altcoin Season Here?

There’s growing speculation that the long-awaited altcoin season has finally arrived. This is the period where altcoins outperform Bitcoin, as investors rotate their funds into smaller, high-potential assets. Recent market activity and technical indicators suggest that this shift is already in motion.

Key Takeaways

- Bitcoin Dominance (BTCD) is Falling: Bitcoin dominance recently dropped from a high of 61.53% to 54.56%, signaling a shift in market focus from Bitcoin to altcoins.

- Altcoin Market Cap (ALTCAP) Hits New Highs: The total value of the altcoin market has reached a new all-time high, driven by strong gains in coins like Dogecoin, Solana, Shiba Inu, and Pepe.

- Technical Indicators Point to Altcoin Season: Bearish divergences on the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) suggest Bitcoin dominance may fall further, which is a classic signal for an altcoin season.

- Market Sentiment Shifts to Altcoins: The Altcoin Season Index is at its highest level since 2022, reaching a value of 89. Sentiment has shifted as traders and analysts forecast major gains for top altcoins like Dogecoin, Solana, and meme coins.

What’s Next for Altcoins?

On December 6, 2024, the Altcoin Season Index hit its highest value of the year, reaching 89 out of 100. This index measures how many of the top 100 cryptocurrencies by market capitalization are outperforming Bitcoin (BTC) over a rolling 90-day period. To put this into context, an index value above 75 signals the start of an altcoin season, while 89/100 suggests that an overwhelming majority of altcoins are currently outperforming Bitcoin.

If the index continues to rise closer to 100, it will serve as even stronger confirmation that altcoins are in control of the market, and Bitcoin’s dominance is waning. This shift could lead to a sustained period of altcoin outperformance, with opportunities for higher returns from altcoins than from Bitcoin.

Another major driver of excitement is the possibility that the altcoin market cap could reach $2 trillion. Analyst MilkybullCrypto has pointed out that the market cap is forming a “cup and handle” pattern, one of the most well-known bullish chart patterns. Historically, this pattern signals the potential for a strong, sustained breakout. If the pattern completes, it could trigger a surge in altcoin prices across the board, marking one of the biggest moves for altcoins in recent history.

Conclusion

As Bitcoin’s historic surge past the $100,000 mark captures global attention, altcoins are also seeing increased activity. Coins like Dogecoin, Ethereum, Solana, and Shiba Inu have shown notable price movements, sparking interest in the broader altcoin market.

With shifts in Bitcoin dominance and analysts highlighting key technical patterns, the possibility of further changes in the crypto landscape cannot be ignored.

Stay ahead of market shifts with Doo Prime’s high-speed trading — 99.5% of orders are executed in under 50 milliseconds. With 24/7/365 professional support, you can adjust your strategy anytime. Trade smarter, trade faster, with Doo Prime.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.