AI Stocks VS The Federal Reserve System (Fed): Navigating The Distorted Stock Market Reality

Despite the fastest interest rate hike in history and the highest inflation in 40+ years, it is remarkable to witness the current unshakable market optimism. The systemic risk in the U.S. banking system continues to persist, elevating the concerns about an imminent downturn in the U.S. economy. However, investors are mesmerized by AI stocks, and they are underestimating the current risks involved. Some have even started to wonder if the next bull market has already begun.

In this article, we will explore the divergence between seven AI stocks and the rest of the market, along with the existing risks, and why it is important for investors to be aware of them, even in the current AI boom.

The Distorted Stock Market

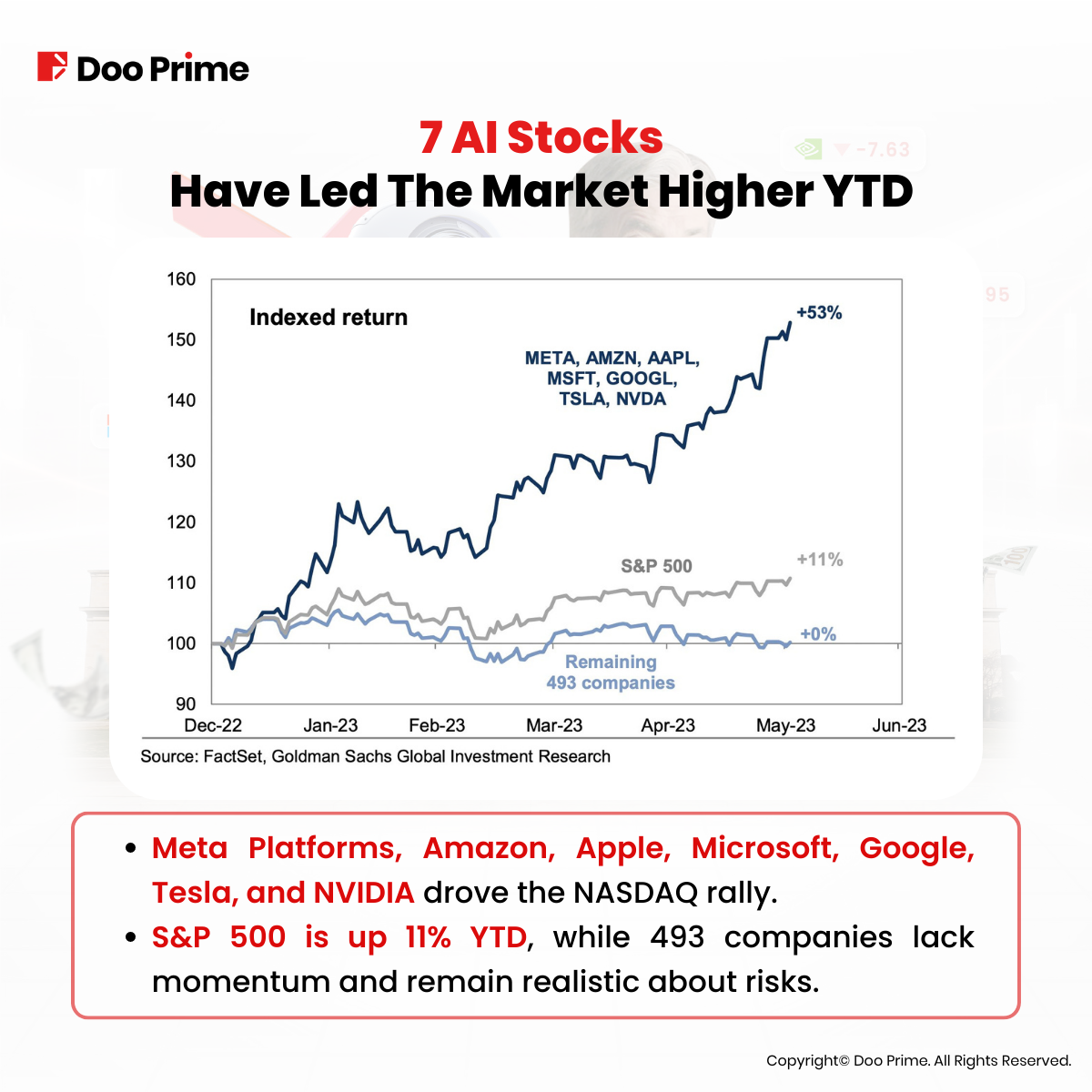

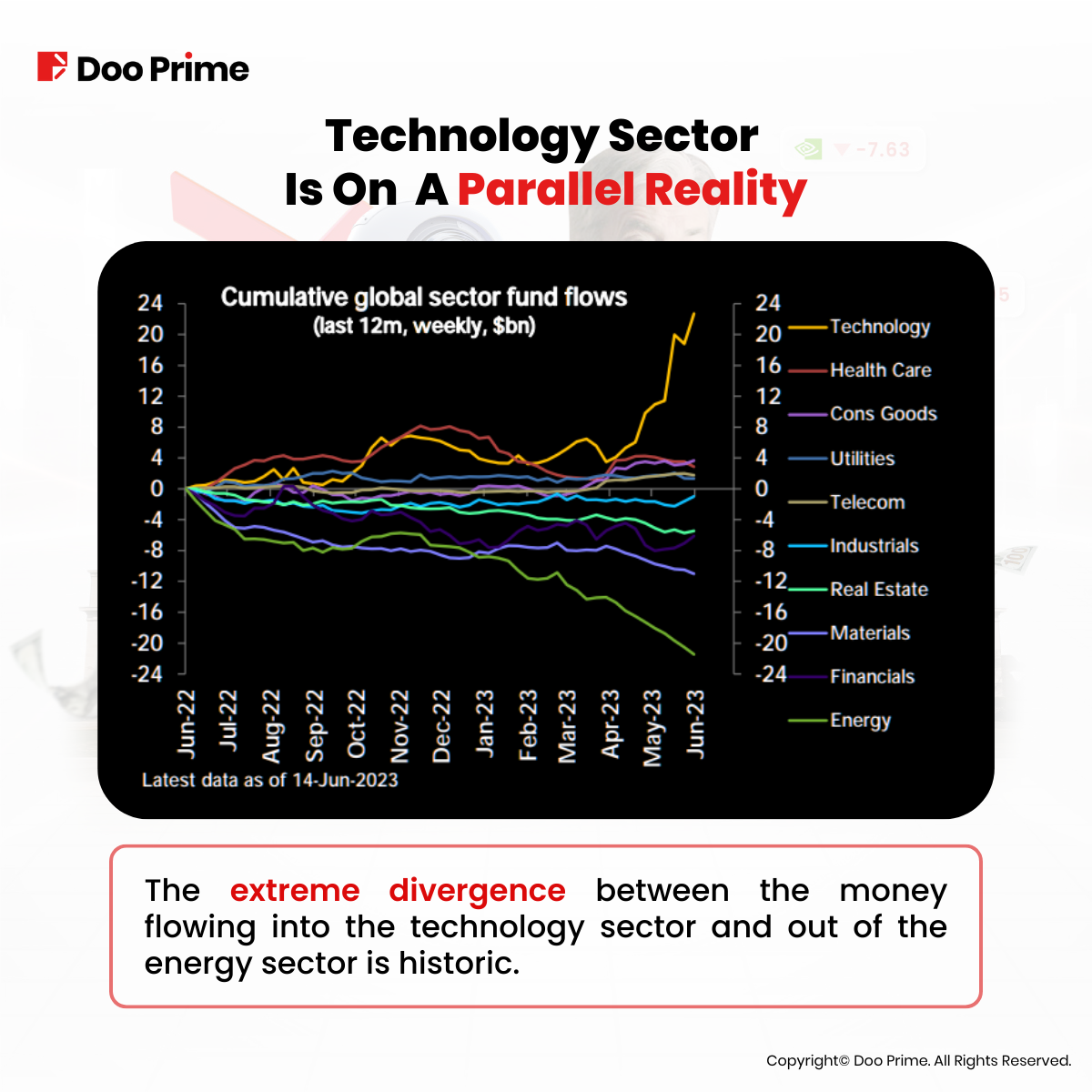

AI hype has taken over the market. Investors have become increasingly bullish on the future of this new technology, and they have forgotten about the rest of the market sectors. The seven AI stocks mentioned above have all seen historic gains in recent months. Meta Platforms, for example, has seen its stock price more than doubled since the beginning of the year. However, in this same period, most of the S&P 500 companies lacked any kind of momentum.

This dissonance between AI stocks and the rest of the market could be a big red flag that investors are quickly brushing off in favor of making potential quick profits.

FOMO (fear of missing out) is a real psychological phenomenon that can impact individual investors’ perception and ultimately the overall market. When investors see other people profiting in a particular sector, they may feel the need to get in on the action and not feel left out, even if they don’t fully understand the sector and the risks involved.

This herd mentality could be driving the recent volatility in AI stock prices. However, the problem is that excessive impulsive investing can create a speculative bubble, which is a situation where the prices of stocks are far higher than their intrinsic value. When the bubble eventually bursts, the reversal could be very fast and severe for investors, causing them to freeze and lose money.

Having said that, investors should remember that AI stocks can still have a long way to go before reaching the ‘bubble danger territory’. However, having the right tools and the right knowledge of when the market sentiment might get sour is key in investing.

The FED Facing A Difficult Decision

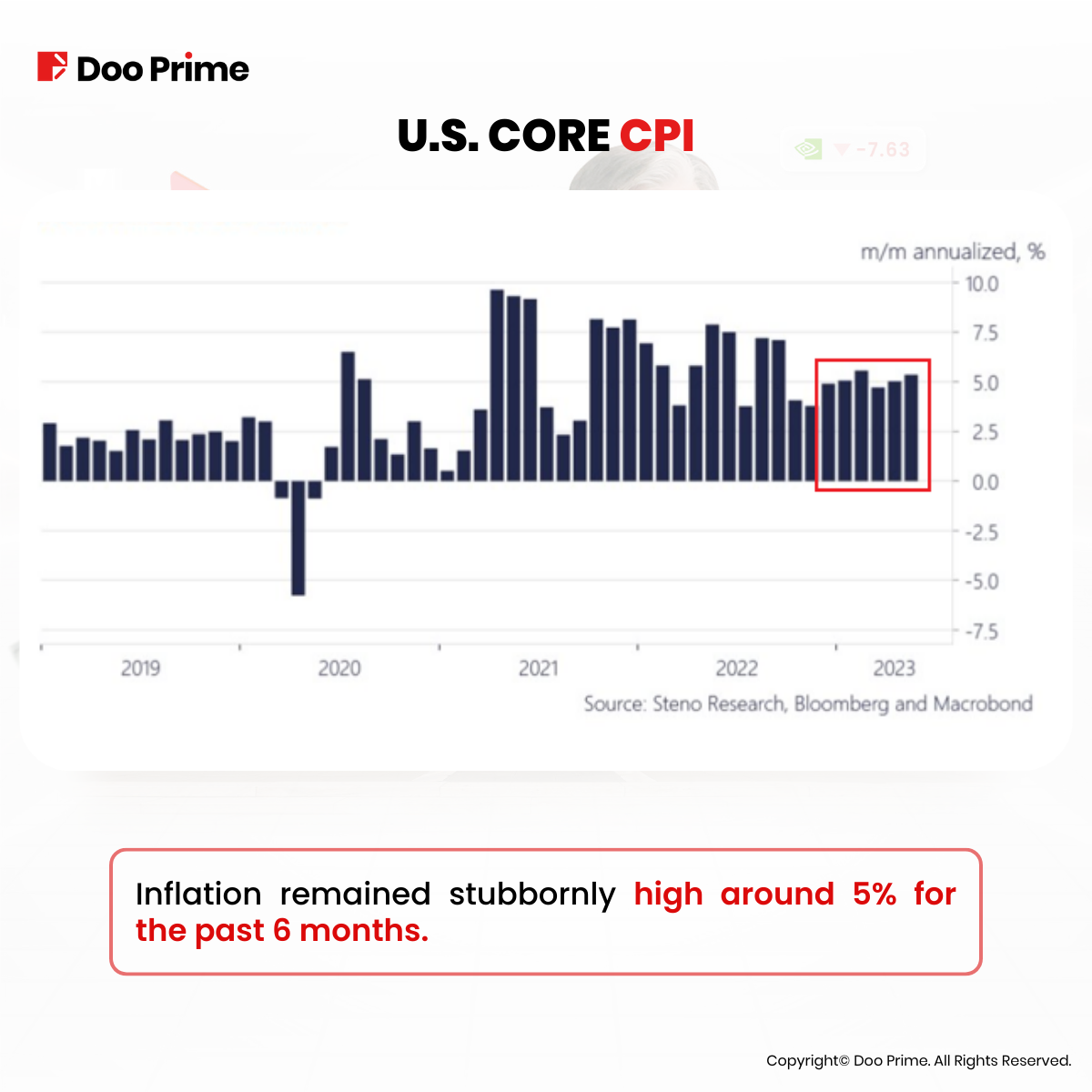

As Inflation seems to be stuck around 5% for the past few months, this led the Federal Reserve to reconsider its recent plans to ‘pause rate hikes’. Chairman Powell reiterated the Fed’s 2% inflation goal and expects more rate hikes ahead as the inflation fight “has a long way to go”. Right after his speech, the odds of a 25-basis point rate hike in July hit 80%, and a 15% chance of 2 more rate hikes by September. Looks like the Fed is not backing down.

Why is this a problem?

The Fed’s decision to reverse course on the rate hike pause is a sign that the central bank is serious about tackling inflation. However, it also raises the risk of a recession. Higher interest rates can lead to slow economic growth, reduce consumer spending and make it harder to borrow money and invest. This is why the Fed is in a quiet predicament. The only strong economic indicator that the Fed is relying on is the unemployment data, which was very stable at 3.7% in May. If Powell raises rates too quickly, it could choke off economic growth and put a dent in the only positive economic indicator.

Therefore, the ultimate challenge for the Chairman is to raise rates just enough to cool down inflation, but he also needs to avoid raising rates so much that it causes a recession.

The next few months will be critical for the Fed as it tries to navigate this difficult trade-off.

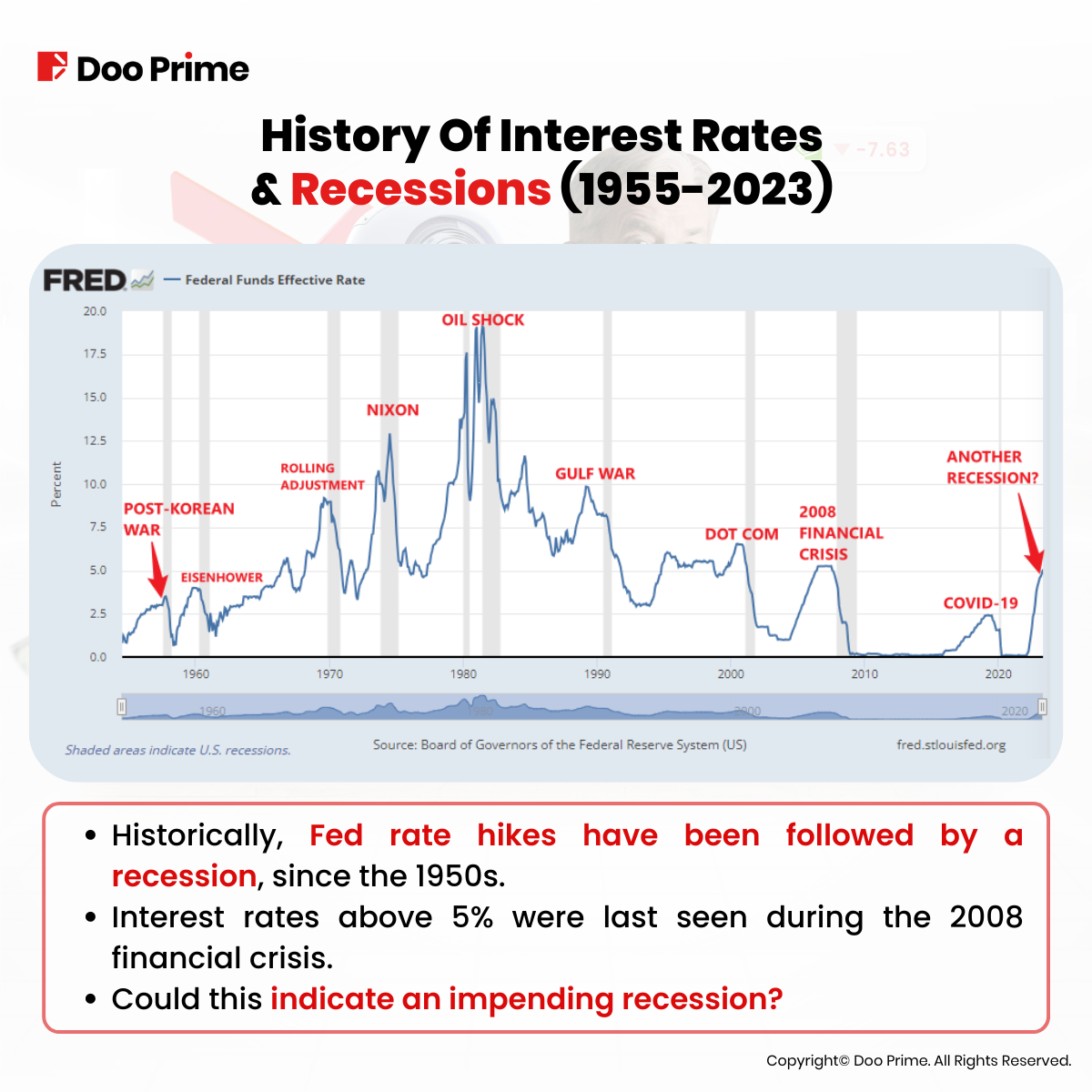

However, the Fed’s track record of avoiding recessions in the past is not quite impressive.

Why Interest Rates Matter?

Understanding interest rate cycles is a key macro component that can help investors navigate through the market cycles more effectively.

Whether the Fed decides to tighten or ease the monetary policy, both have a huge impact on the overall market cycles. Understanding the difference between the two and the impact that it has on the market is crucial for any investor.

In this current environment, the Fed keeps tightening the monetary policy to fight this stubborn high inflation. However, the downside of higher rates is that it can lead to a slowdown in economic growth, a decline in risky asset prices such as stocks, and poses systemic risks in the banking sector.

Why does the banking sector get hurt?

Higher rates make it more expensive for banks to borrow money, which can reduce their profitability and can lead to a number of problems such as increased loan defaults and reduced lending.

We already had three banks liquidated and collapsed this year, Silicon Valley Bank, Signature Bank, and First Republic Bank. If rates keep going higher, we might see some more.

Do you remember how the 2008 financial crisis began? It was with the collapse of the Lehmann Brothers investment bank.

The chart above suggests that we may be in a late market cycle with interest rates keeping on rising. Additionally, History shows us that the potential consequences of a hawkish Federal Reserve are not to be taken lightly. If that’s our case right now, then it could be only a matter of time before something “breaks” in the economy and triggers a recession.

What To Expect With This Market Cycle

Having said all of that, recessions are a natural and necessary part of every market cycle to remove excess, reprice assets, and tame risky behavior. Therefore, if the alarm bells start ringing in the next 6 to 12 months, investors should recognize that it is a natural part of the market cycle and that it can be beneficial in the long run.

After every recession, there is always a new bull market arising with new opportunities. A lot of investors believe that the AI bull market has already started, but a lot of data suggest otherwise. It is crucial to remain cautious, consider broader market sectors, and understand the impact of the interest rate cycles to navigate the market effectively.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.