Today’s News

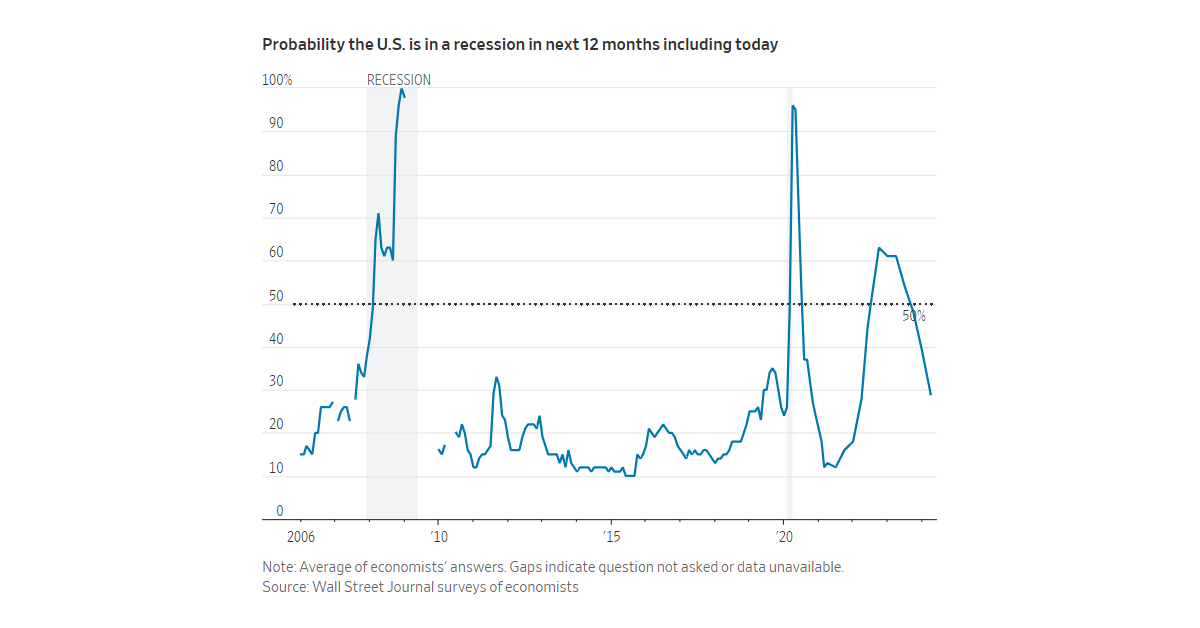

The latest Wall Street Journal survey paints a notably optimistic picture of the U.S. economy, with economists revising their growth forecasts upward. The likelihood of a recession in the coming year has dwindled, now standing at 29%, a significant drop from 39% in January.

Image Source: Wall Street Journal

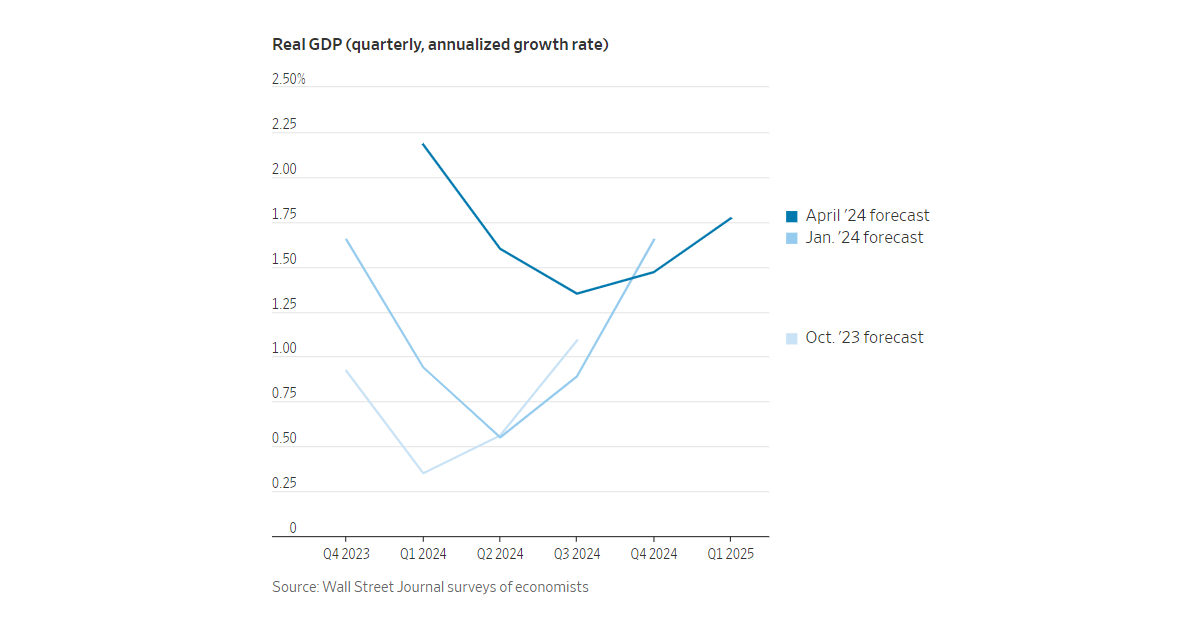

This marks the lowest probability since April 2022. In contrast to earlier projections of sluggish growth, experts now anticipate a bottoming out at 1.4% inflation-adjusted growth in the third quarter. Only a minority, 10% of respondents, foresee any negative growth quarters in the next year, a notable decrease from 33% in January.

Image Source: Wall Street Journal

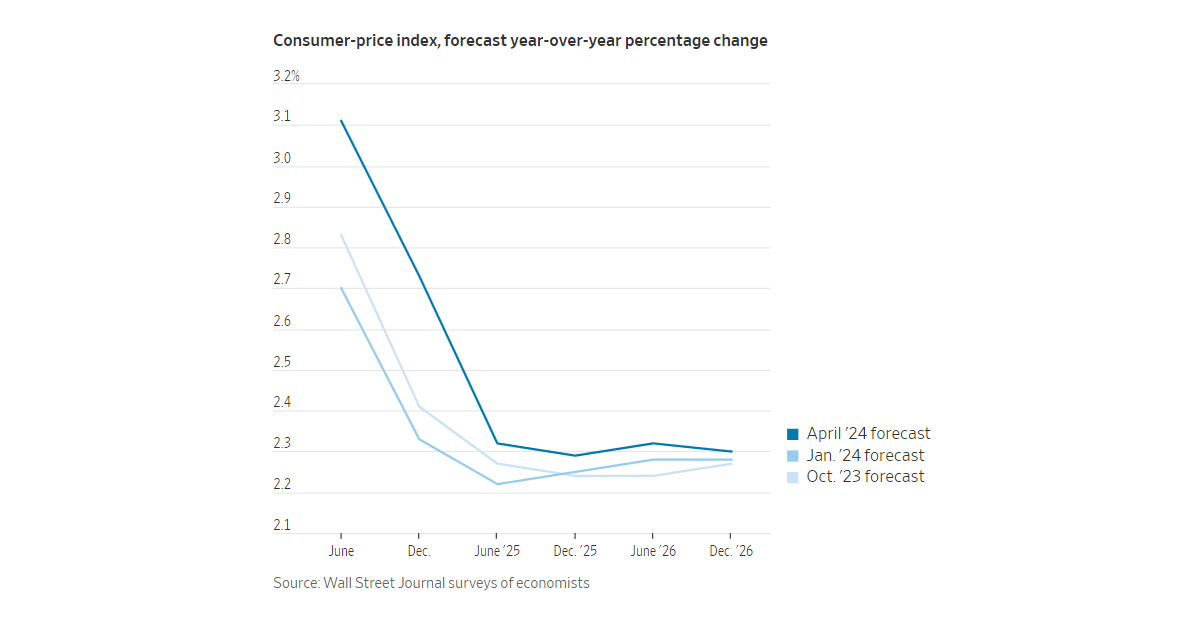

Despite concerns about inflation—underscored by recent data showing higher-than-expected consumer prices— the U.S. economy has defied expectations, maintaining robust expansion. While replicating last year’s exceptional 3.1% growth might be challenging due to various temporary factors, economists have adjusted their forecasts upward, with an average estimate of 2.2% growth for the first quarter of the year.

James Smith, an economist at EconForecaster, remarked on the exceptional performance of the U.S. economy, branding it as the “envy of the world.” This sentiment is in stark contrast to the cautious outlook of two years ago when the Fed was implementing aggressive interest rate hikes. Despite a considerable increase in the federal funds rate, economists no longer anticipate numerous rate cuts, indicative of their confidence in the economy’s resilience.

Image Source: Wall Street Journal

Furthermore, economists now believe that the economy can tolerate higher interest rates, underpinned by expectations of increased worker productivity. Forecasts suggest a rise in productivity matching historical averages, which could fuel growth beyond previous expectations. Joe Brusuelas, chief economist at RSM U.S., even envisions a virtuous cycle of elevated productivity, growth above the long-term trend, and manageable inflation and unemployment rates.

However, not all economists share this upbeat sentiment. Concerns linger regarding the potential for inflation to remain stubbornly high, posing a challenge to the Federal Reserve’s target of 2%. Despite projections of a decline in core PCE inflation to 2.1% by the end of next year, some fear that the Fed’s inflation-fighting measures could stifle economic growth.

Other News

Franklin Templeton’s Private Investing Shift

Franklin Templeton diversifies into private credit and real estate with USD 260 billion in assets, seeking to counteract dwindling investor interest in traditional mutual funds.

China’s Central Bank Holds Rates, Drains Cash

The People’s Bank of China keeps its key rate steady and withdraws funds, aiming to stabilize currency amid economic uncertainties and market expectations of U.S. Federal Reserve actions.

Concerns Rise As U.S. Bond Sales Surge

Worries escalate among investors as weak auctions and record bond issuance fuel concerns about market absorption and volatility amidst uncertainties surrounding inflation and interest rate policies.