Today’s News

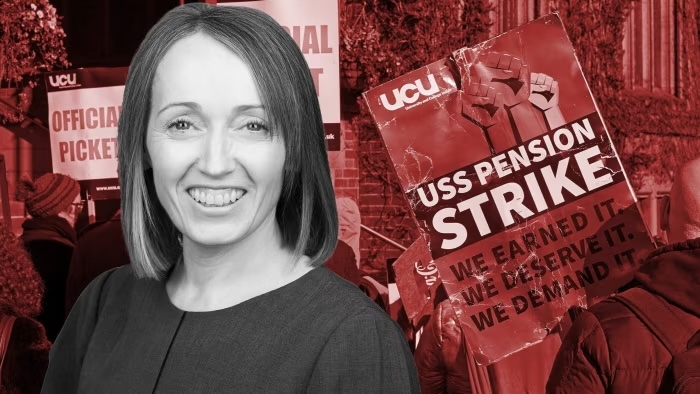

Image Source: Financial Times

The chief executive of the Universities Superannuation Scheme, the U.K.’s largest private sector pension scheme, has cautioned against excessive government intervention in managing retirement funds.

Carol Young, leading the GBP 73 billion (USD 92 bn) scheme, expressed her support for new disclosure requirements on U.K. investments but raised concerns about potential ministerial directives to allocate funds. While acknowledging the importance of transparency, Young emphasized that trustees must retain the right to choose their investment strategy to serve the best financial interests of pension members.

“There’s no question that the primary purpose of [pensions] is to deliver in the members’ best financial interests,” Young said. “Trustees need to exercise their fiduciary duties and these are heavy responsibilities that are placed on them. They need the rights that go with that and one of those is the right to select their investment strategy.”

The government refrained from commenting on Young’s remarks, made prior to the weekend announcement of pension reforms by the Treasury, part of Chancellor Jeremy Hunt’s strategy to boost the economy by unlocking retirement savings for domestic investments.

The proposed reforms include mandatory disclosure by defined contribution pension schemes on their U.K. investments starting in 2027. Funds will also be required to publish performance data, with poorly performing schemes facing restrictions on new business. Hunt stated that these measures aim to encourage British pension funds to contribute more to the domestic economy.

Young expressed support for initiatives making U.K. investments more attractive, noting that half of USS’s GBP 73 billion (USD 92 bn) portfolio is already invested domestically. Her comments highlight industry concerns about the government’s ability to redirect retirement savings into British projects given fiscal pressures.

Over the past year, the government has introduced measures encouraging funds, managing over GBP 1 trillion (USD 1.26 tn), to invest in high-growth unlisted companies, potentially more expensive assets for savers. The City of London Corporation welcomed the new pension measures, anticipating increased investment in U.K. businesses.

Addressing potential challenges in the sector, Young, who assumed the role of USS CEO five months ago, highlighted efforts to avoid a recurrence of past disputes within university staff. Collaborating with stakeholders, including a working group, she is focused on stabilizing the scheme’s funding position and preventing future conflicts. According to Young, all parties involved are aligned in the same direction.

Other News

Santander Trims U.S. Workforce Amid Digital Shift

Santander cuts approximately 320 jobs in the U.S., about 2.7% e51C1cof its workforce, as the Spanish bank shifts its focus towards digital operations, aiming to adapt to changing customer needs.

Greece’s Bank Bailout Fund Begins Stake Sale In Piraeus Bank

Greece’s bank bailout fund announces the initiation of a stake sale, offering up to 22% of Piraeus Bank, with the option for an increase. The sale, occurring from March 4-6, involves a price range of 3.7 to 4 euros per share.

Tory Housing Crisis: Stagnant Rates Fuel Criticism

The Conservative party faces criticism for its 14-year failure to resolve the U.K.’s housing crisis, with home ownership rates stagnant and targets unmet.