Today’s News

Image Source: The Wall Street Journal

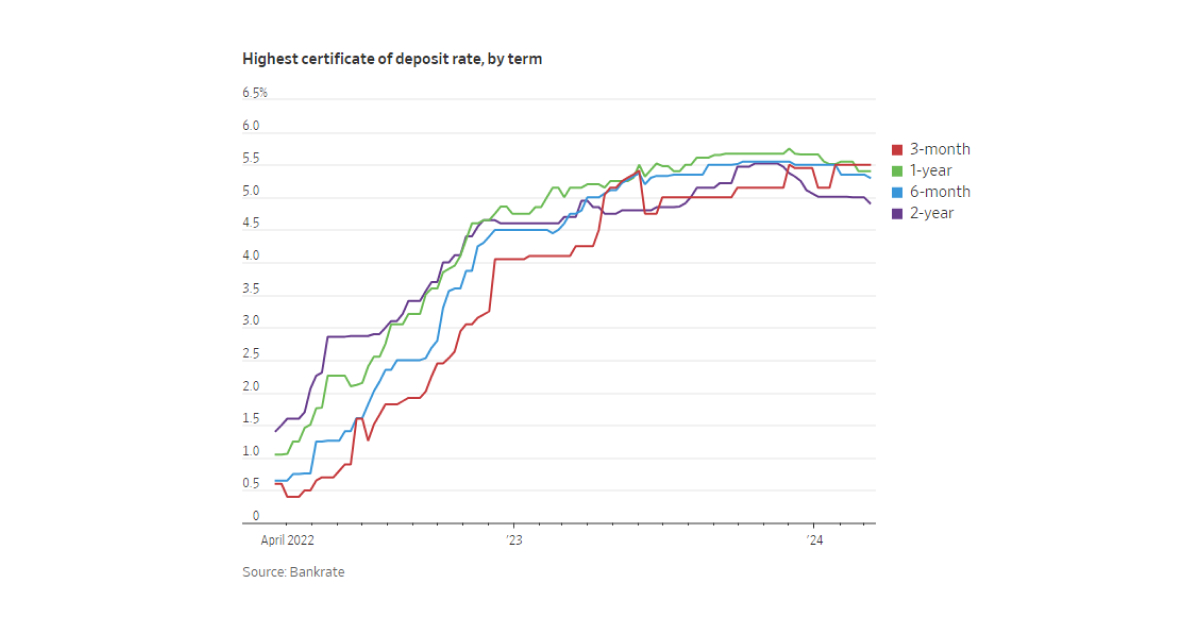

Cash investments have been a popular choice, offering substantial returns, particularly exceeding 5%, ever since the Federal Reserve began raising interest rates. However, the landscape is shifting as the central bank hints at potential rate cuts. Certificates of deposit (CDs), money-market funds, and similar investments have been yielding attractive returns, but signs of change are emerging.

The Fed’s recent indication of potential rate cuts has begun affecting various cashlike investments, with some witnessing a decline in yields. For instance, CDs, which were once offering attractive rates for longer durations, now predominantly feature shorter-term offers. While three-month CDs may still offer rates as high as 5.5%, longer-term CDs have seen a decrease in yields, dropping below the 5% mark.

This shift is evident in consumer behavior as well, with the majority of high-rate CDs opened in February having durations of less than a year. Adam Stockton, managing director at Curinos, notes that “Most consumers look at the rate first and the term second”, “But the term will be more important, particularly if the central bank cuts rates later this year”, he said.

However, not all cash investments are affected equally. Money-market funds, for instance, have seen a surge in popularity, now holding a record USD 6.5 trillion in assets, with average rates hovering around 5.14%. Nevertheless, uncertainties persist as the Fed’s stance on rate cuts remains subject to change, potentially influenced by unexpected fluctuations in inflation.

Despite the current high returns on cash, investors are diversifying their portfolios. Some have shifted back to the stock market, drawn by its recent strong performance. Financial adviser Ashlea Jones notes instances where clients have redirected funds from maturing CDs back into stocks.

The changing landscape poses new considerations for savers. For instance, the timing of investments in CDs becomes crucial, with those purchased amid declining rates potentially yielding higher returns over time compared to shorter-term options. Similarly, retirees or prospective home buyers may still find value in longer-term CDs, despite lower returns, for the stability they offer in generating predictable income.

As the era of effortless 5% returns on cash draws to a close, investors must adapt to the evolving financial environment, considering new strategies to optimize returns while managing risks effectively.

Other News

U.S. Pressures Raiffeisen To Drop Russian Tycoon Deal

The United States urges Raiffeisen Bank International to drop its EUR 1.5 billion (USD 1.64bn) deal with a Russian tycoon’s stake, citing concerns over sanctions violations. Raiffeisen shares plummeted by as much as 16%.

Fed’s Powell Signals Uncertainty Amid Forecast Adjustment

Federal Reserve Chair Jerome Powell acknowledges uncertainty as policymakers adjust their longer-term interest rate estimates, signaling a potential departure from very low rates but emphasizing ongoing unpredictability.

Reddit Prices IPO At High End, Raises USD 748M

Reddit prices its IPO at USD 34 per share, raising USD 748 million, signaling a boost for the tech IPO market. Despite financial losses, Reddit’s loyal user base and diverse forums position it for growth and innovation.