Today’s News

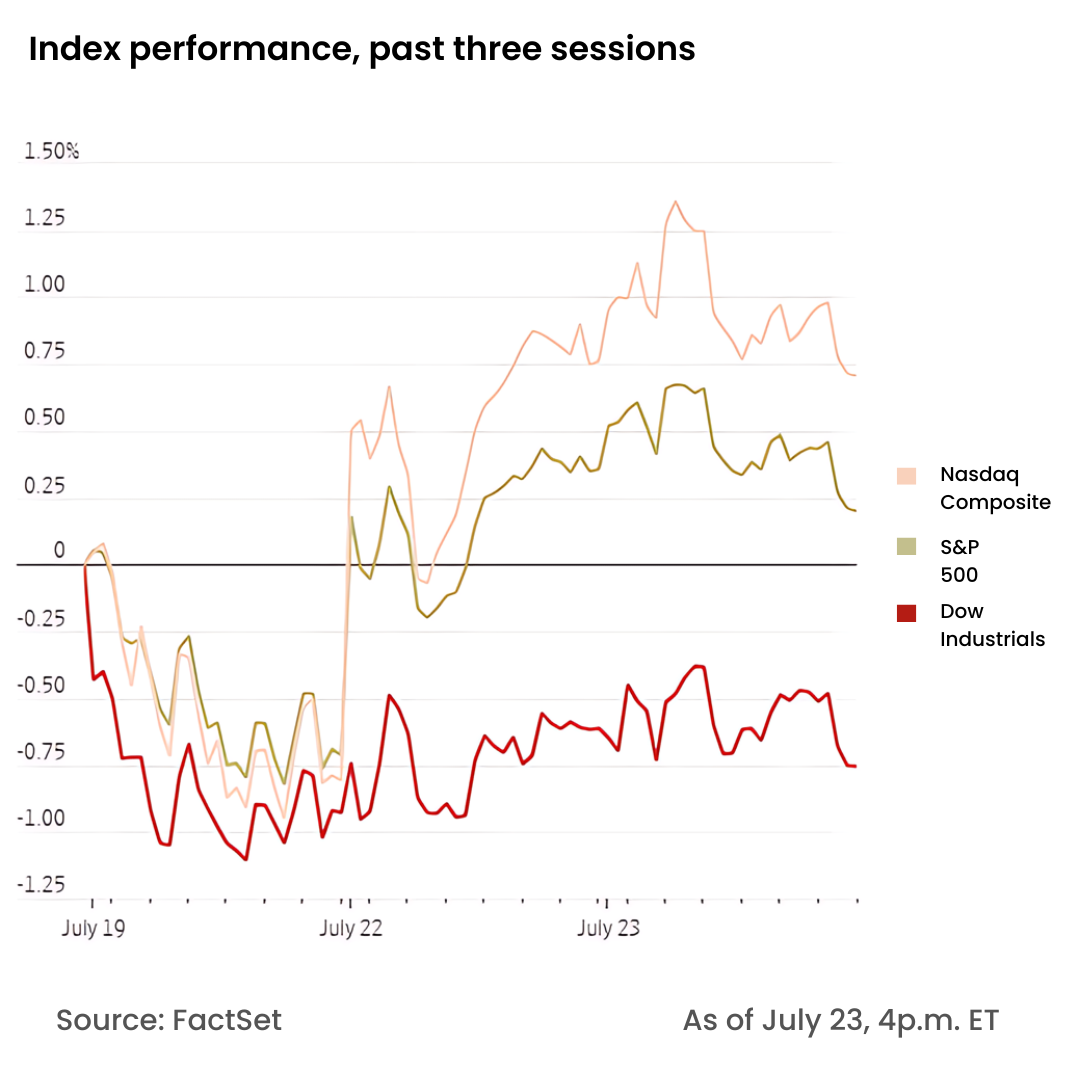

Tuesday’s stock market session appeared calm on the surface, but underlying movements revealed significant volatility as key earnings reports came to the surface. The Nasdaq Composite dipped slightly by 0.1%, the S&P 500 fell by 0.2%, and the Dow Jones Industrial Average decreased by 57 points, or 0.1%.

Image Source: CNBC

Recent focus has been on a tumultuous U.S. presidential election and significant market shifts, but Tuesday redirected attention to a series of impactful corporate earnings. United Parcel Service saw its shares tumble by 12%—the day’s largest drop in the S&P 500—after reporting weaker-than-anticipated revenue and reducing its financial outlook.

Image Source: The Star

Image Source: Detroit Free Press

Conversely, Spotify experienced a 12% rise after announcing its second consecutive quarterly profit. General Motors’ shares declined 6.4%, marking its poorest daily performance since 2022, as market concerns about its shrinking market share in China overshadowed strong domestic sales.

The session highlighted continued high volatility in individual stock performance, driven by speculation on potential winners and losers from the artificial intelligence surge and anticipated rate cuts. Meanwhile, 10-year Treasury yields remained relatively stable at 4.240%.

Image Source: Wall Street Journal

In the commodities sector, subdued fuel demand pushed U.S. oil prices to their lowest since June 7, dropping 1.8% to USD 76.96 a barrel. Copper futures also fell, marking a seventh consecutive day of losses—the longest streak since February 2020—amid cooling expectations for an AI-driven data center boom.

On a day of mixed results, major stock indexes oscillated between slight gains and losses as investors digested the initial wave of major corporate earnings. Lockheed Martin’s shares climbed 5.6%, enjoying the best day of the year after the company upgraded its profit forecast due to ongoing conflicts in Ukraine and the Middle East.

GE Aerospace also saw a significant jump of 5.7% due to robust demand for its commercial engines and services. In contrast, truck manufacturer Paccar saw an 11% decline after its earnings fell short of Wall Street expectations.

Investors were particularly focused on Tesla and Alphabet’s earnings, released after market close, for signs of whether the trend of rotating from big tech to smaller firms would persist. “We are definitely past the euphoria stage of this [AI] trend,” said John Belton, a portfolio manager at Gabelli Funds. “It’s now time to see some real tangible results.”

Analysts from Goldman Sachs and other firms have begun to question the long-term payoff of AI investments, which contributed to a broader selloff in major tech stocks the previous week. At the same time, many investors have reallocated funds towards smaller and medium-sized companies, which have suffered under higher interest rates but may benefit from potential rate cuts.

Belton added, “It’s not to say the rotation can’t continue,” reflecting on the strong performance of big tech stocks supported by earnings surpassing Wall Street’s forecasts.

On this eventful day, the Russell 2000 index, which tracks small and midsize companies, outshone larger indices with a 1% gain. “It’s been such a long, long period of underperformance for small-caps,” commented Samuel Dedio, chief investment officer at Patrumin Investors, who remains optimistic after the Russell 2000’s 9.6% gain so far this month.

Other News

U.S. Ether ETFs Launch Successfully

U.S. spot ether ETFs made a robust market debut, signaling a new milestone for the cryptocurrency industry, with significant trading volumes achieved on their first day.

U.K. Tightens Rules on Bank Branch Closures

The U.K. has introduced stricter regulations requiring banks to ensure continued local access to cash before closing any branches, driven by the Financial Conduct Authority.

Visa Misses Quarterly Revenue Estimates

Visa reported a rare shortfall in third-quarter revenue, missing Wall Street expectations as high interest rates curbed consumer spending, leading to a 4.6% drop in its shares after hours.