Today’s News

South Korea’s individual investors are increasingly turning to U.S. stocks, defying last week’s global market turmoil. This trend highlights their preference for international markets over domestic investments, driven by the perceived lack of value in South Korea’s stock market.

Image Source: Associated Press

Retail investors have been heavily buying shares of U.S. companies like Nvidia, Tesla, and Apple this year, spurred by the global AI boom. This shift comes despite government efforts to strengthen the local stock market.

However, many South Korean investors remain frustrated with the so-called “Korea discount,” where local companies offer lower shareholder returns and suffer from undervalued stock prices.

For example, the average dividend payout ratio over the past decade for South Korean companies was 26%, significantly lower than Taiwan’s 55%, Japan’s 36%, and the U.S.’s 42%. Additionally, South Korean companies’ price-to-book ratio averaged 1.04, compared to 3.64 for U.S. companies.

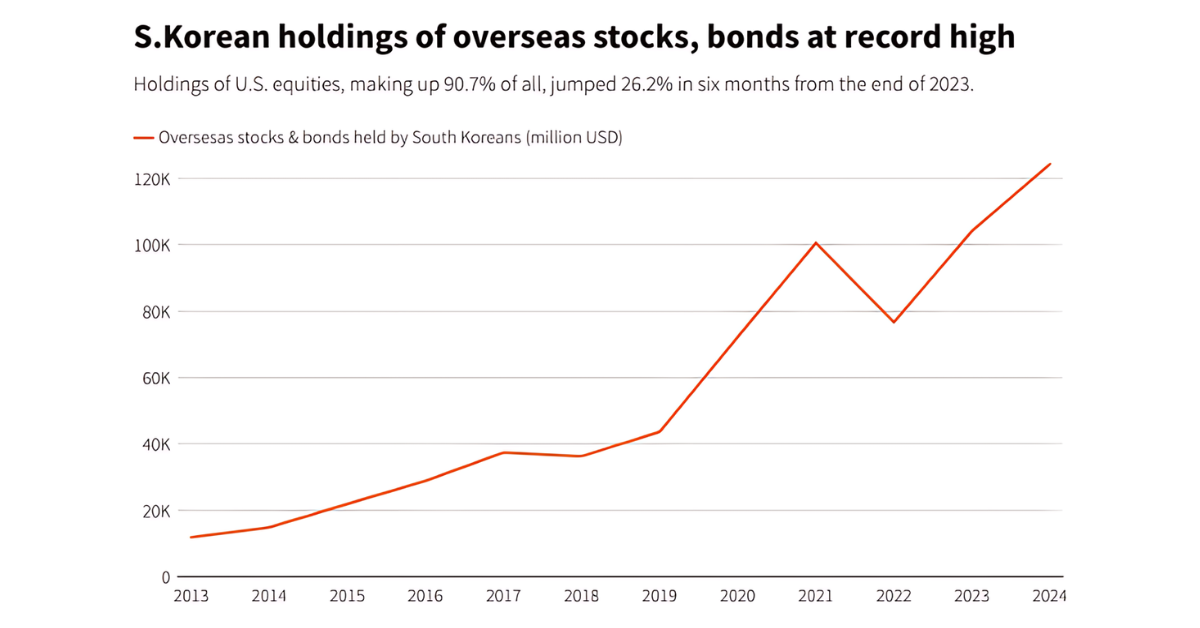

Data Source: Korea Securities Depository

Image Source: Reuters

This disparity has led South Korean investors, known as “ants” for their collective strength, to pour USD 9 billion into U.S. stocks between January and July this year, after a brief sell-off in 2023. In contrast, they sold a record 16.3 trillion won (USD 11.9 billion) worth of domestic stocks during the same period, causing the KOSPI index to drop by 1.3% year-to-date, while the S&P 500 and Nikkei rose by 13% and 5%, respectively.

The ongoing trend poses a challenge to the South Korean government’s efforts to revitalize the local stock market. Despite foreign investors increasing their stakes in South Korean stocks, retail investors’ outflows are undermining these efforts.

Some analysts believe that planned capital market reforms, including tax incentives and the proposed “Corporate Value-up Programme,” may not be enough to reverse the trend, especially given the opaque governance structures of South Korea’s family-run conglomerates, or “Chaebols.”

Elon Musk recently praised South Koreans as “smart people” in a social media post, noting that Tesla is the top U.S. stock held by South Koreans, with holdings valued at USD 13.6 billion as of the end of July, followed by Nvidia and Apple.

Investors like Oh Jeong-min and Sunny Noh remain committed to U.S. markets, citing better returns and more favorable shareholder policies compared to South Korea. Despite recent market volatility, they plan to continue investing in U.S. stocks, viewing the American market as the better long-term option.

Other News

U.S. Manufacturers Face Surging Insurance Costs

Property and casualty insurance costs for U.S. manufacturers are skyrocketing, with premiums rising up to 200%, hitting high-risk industries like foundries hardest.

China’s Investment Quotas Tighten as Demand Surges

Chinese investors’ growing demand for offshore investments has led foreign banks and fund managers to creatively navigate the limited quotas in China’s QDII program.

CBA’s Profit Beats Estimates, Declares Record Dividend

Commonwealth Bank of Australia posted a cash profit of AUD 9.84 billion (USD 6.51B), exceeding expectations, and declared a record AUD 2.50 (USD 1.66) per share dividend.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.