Today’s News

Image Source: Wall Street Journal

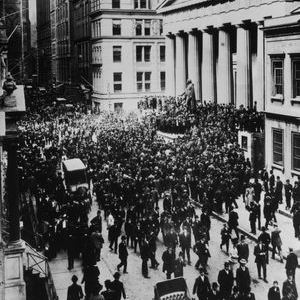

America’s largest bank, JPMorgan Chase, has made a significant move by closing its branch located on Wall Street, marking the end of a more than 150-year association between the bank and the iconic financial hub. The decision, announced on Friday, signals a profound shift in the traditional landscape of American finance.

While this move may not immediately impact the area’s tourist footfall, it underscores a broader trend of banks and brokerages relocating from Wall Street to other areas in Manhattan and beyond, a trend accelerated by events such as the September 11 attacks and the subsequent Covid-19 pandemic.

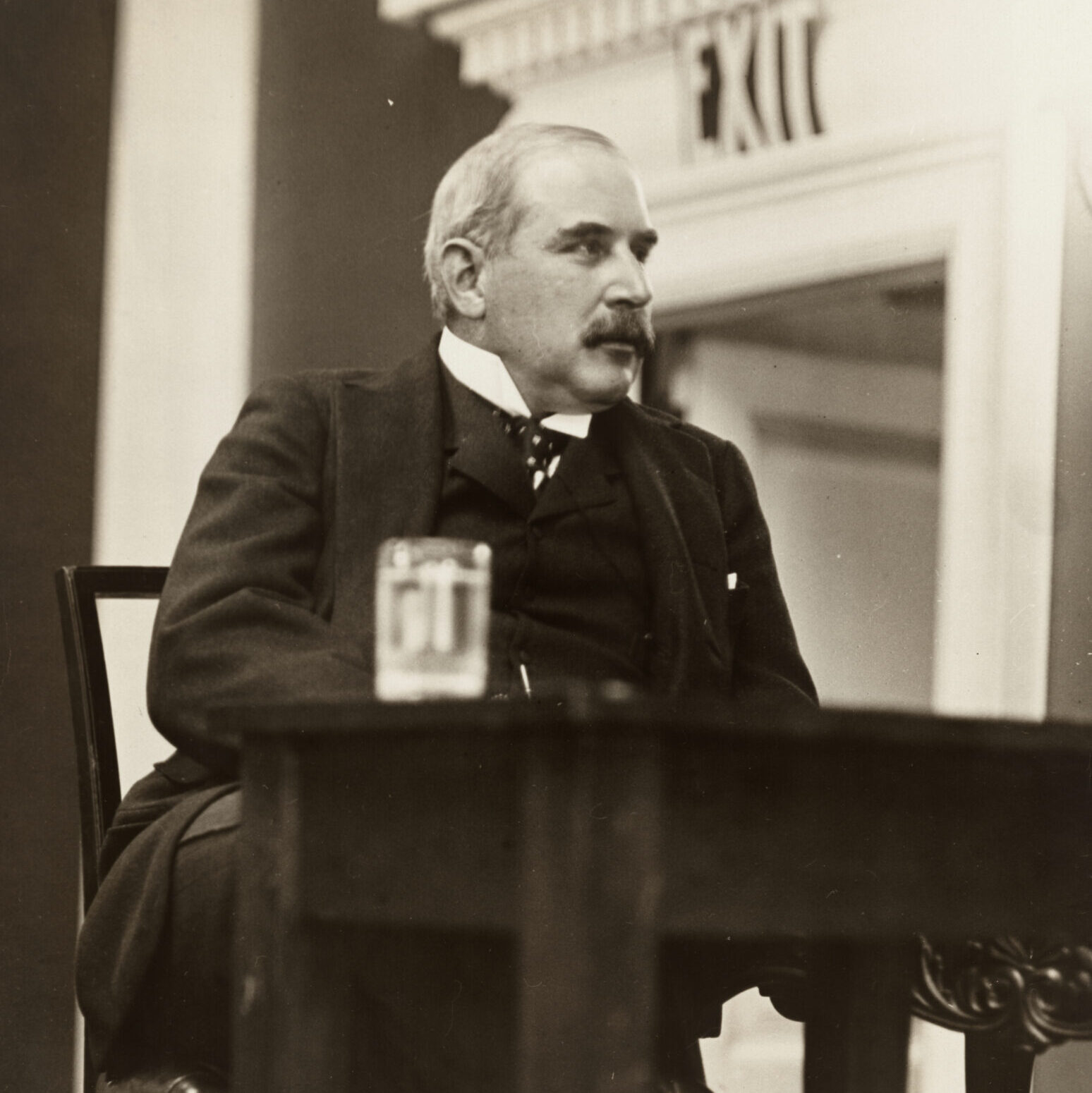

JPMorgan’s departure is particularly noteworthy due to its rich history in the neighborhood, with its roots dating back to the era of J. Pierpont Morgan, whose influence helped shape the U.S. into a global financial powerhouse. The vacated Wall Street buildings, once bustling with financial activity, now stand as empty reminders of a bygone era, with historic landmarks such as 23 Wall St. now devoid of their former occupants.

Image Source: Philanthropy Roundtable

Image Source: Getty Images

Image Source: Wall Street Journal

The decline in foot traffic on Wall Street has taken its toll on local businesses, such as Sunil Rally’s newsstand, which has seen a significant drop in customers since the pandemic began. Despite the dwindling presence of financial institutions, Wall Street continues to attract tourists drawn to its historic sites, including the Fearless Girl statue, although the once-thriving financial district now feels like a shadow of its former self.

Reflecting on the street’s illustrious past, it’s evident that Wall Street played a pivotal role in shaping America’s journey from a rural nation to a global financial powerhouse, with institutions like J.P. Morgan & Company and the Bank of New York at the forefront of this transformation. However, as the financial sector evolved and corporations grew larger, the limitations of Wall Street’s infrastructure became apparent, leading to the gradual exodus of banks from the area.

JPMorgan’s decision to relocate its headquarters from 23 Wall St. to Midtown Manhattan in 2001 marked a significant turning point, further cementing the shift away from Wall Street as the epicenter of American finance. Today, for the few banks that remain, Wall Street serves primarily as a hub for retail branches, a stark contrast to its former role as the nerve center of global finance.

While JPMorgan’s closure may signal the end of an era for Wall Street, the street’s legacy as a symbol of American finance continues to endure, albeit in a different form.

Other News

Nasdaq Records Worst Weekly Performance Since 2022

The Nasdaq endured its worst week since 2022 as Israel’s strike on Iran spiked oil prices and exacerbated concerns over inflation and interest rates, highlighting escalating tensions in the Middle East.

Warbasse Housing Complex Spurs Banking Sector Concerns

The Amalgamated Warbasse Houses, a vast apartment complex near Coney Island, became a focal point of banking industry distress when New York Community Bancorp incurred significant losses on real-estate loans.

Canada Supply Management Bill Progresses Amid Controversy

Yves Perron’s Bloc Québécois-backed bill, passed by the Senate, seeks to safeguard Canada’s supply management for dairy, poultry, and eggs from trade negotiations, sparking debate over its impact on consumer prices and farming industry stabilit