Today’s News

Image Source: CNN

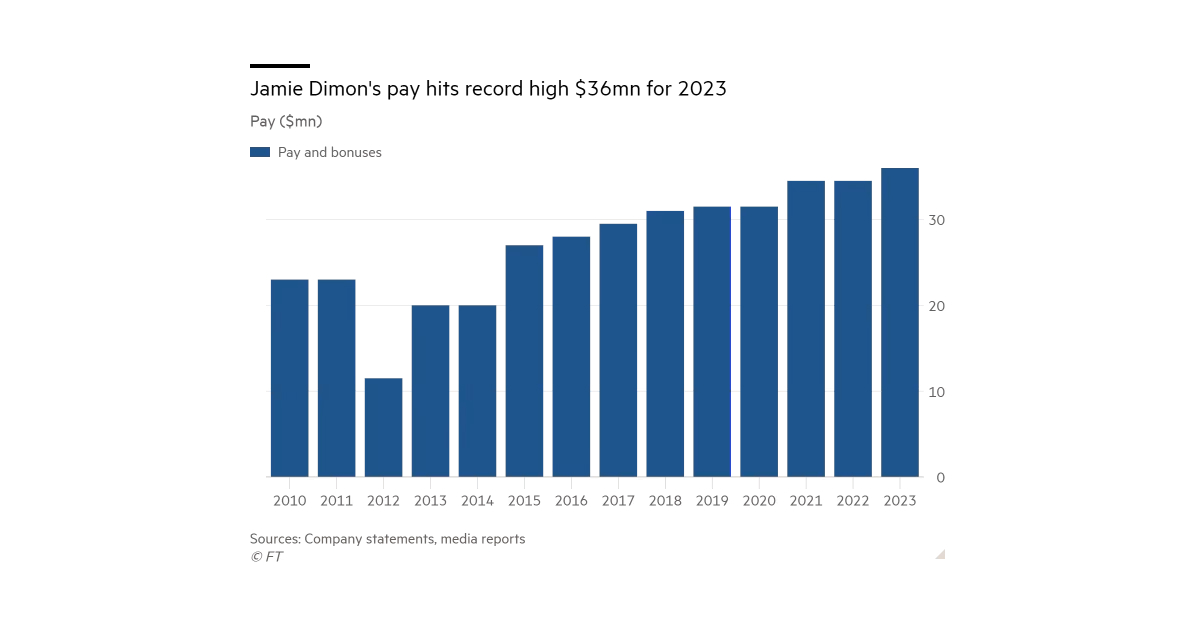

JPMorgan Chase paid its longstanding chief executive, Jamie Dimon, a record compensation of USD 36 million for the year 2023, marking a 4% increase from the previous year. Dimon, at the helm since 2005, received the substantial pay raise following a year of remarkable profits, nearly hitting USD 50 billion, surpassing industry peers.

The bank attributed Dimon’s elevated compensation to his adept stewardship, citing growth across all key business sectors, unprecedented financial results, and a robust balance sheet. The USD 36 million package includes a USD 1.5 million base salary and a USD 34.5 million bonus, predominantly in the form of stocks.

Image Source: Financial Times

JPMorgan, in a regulatory filing on Thursday, stated that, “The annual compensation for 2023 reflects Mr Dimon’s stewardship of the firm, with growth across all of its market-leading lines of business, record financial results and a fortress balance sheet”.

In tandem with Dimon’s raise, other top executives also experienced salary bumps in 2023. JPMorgan President Daniel Pinto saw a 5% increase to USD 30 million, while Consumer Business co-heads Jennifer Piepszak and Marianne Lake, potential successors to Dimon, received USD 18.5 million each, reflecting a nearly 6% uptick.

Renowned for consistently topping the list of highest-paid CEOs in major U.S. banks, Dimon’s net worth, valued at approximately USD 1.9 billion by Forbes, is largely tied to JPMorgan stock. Last year marked a shift for Dimon, who, after nearly two decades of holding onto his JPMorgan shares, announced plans to sell a portion, estimated to fetch over USD 140 million at the time of the announcement.

Dimon’s compensation has not been without controversy, with shareholders expressing discontent in the past. Two years ago, investors objected to a special award projected to be worth around USD 50 million over several years, leading to a majority voting against the pay plan in a non-binding “say on pay” vote at the bank’s 2022 annual investor meeting.

Other News

Passive Funds Triumph As Assets Hit USD 13.3tn

U.S. passive funds now exceed active counterparts, reaching USD 13.3tn in assets, reflecting a transformative trend fueled by ETF popularity and consistent inflows.

Wells Fargo Atwater Branch Rejects Unionization

Employees at Wells Fargo’s Atwater branch in California voted against joining a union, becoming the first site to resist unionization within the bank.

U.S. Regional Banks Raise USD 4.75bn In Confident Bond Sales

Citizens Bank and U.S. Bancorp’s USD 4.75 billion bond sales showcase renewed investor confidence in regional banks post-March crisis, with both deals priced below initial levels.